Game-Changing: Banks Replaced by Crypto Exchanges? Bitcoin News

Title: परदे के पीछे इतना बड़ा खेल! BANKS REPLACE करने वाले है CRYPTO EXCHANGES? BITCOIN BIG NEWS & GAME

Introduction:

The world of cryptocurrencies has been witnessing a significant surge in popularity and adoption in recent years. As more people become interested in digital assets like Bitcoin, the traditional banking sector is starting to take notice. In this article, we will explore the possibility of banks replacing crypto exchanges and the potential implications of such a development. We will also seek insights from crypto experts to shed light on this fascinating topic.

FAQs

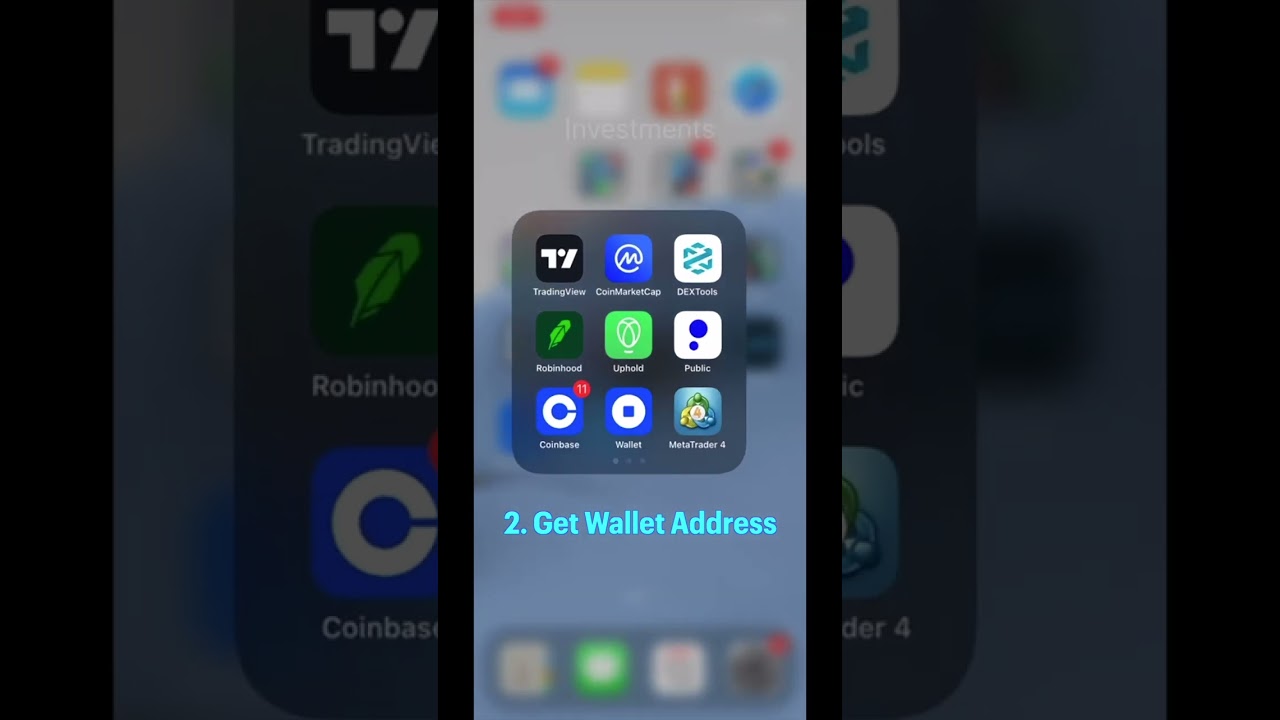

1. What are crypto exchanges?

Crypto exchanges are online platforms where individuals can buy, sell, and trade cryptocurrencies. These platforms facilitate the exchange of digital assets and provide users with a secure environment to manage their crypto holdings.

2. How do banks currently interact with cryptocurrencies?

Currently, most banks have a cautious approach towards cryptocurrencies. Some banks have banned their customers from using their accounts for crypto-related activities, while others have started offering limited services, such as custodial solutions for institutional investors. However, the overall involvement of banks in the crypto space is still relatively limited.

3. Why would banks consider replacing crypto exchanges?

Banks are known for their robust infrastructure, regulatory compliance, and trustworthiness. By entering the crypto market, banks could potentially offer a more secure and regulated environment for individuals to trade cryptocurrencies. This move could attract a wider range of investors who are hesitant to use traditional crypto exchanges due to concerns about security and regulatory compliance.

4. What are the potential benefits of banks replacing crypto exchanges?

– Enhanced security: Banks have well-established security protocols in place, which could provide users with a higher level of protection against hacking and fraud.

– Regulatory compliance: Banks are subject to strict regulations, and their involvement in the crypto market could help address concerns related to money laundering and illicit activities.

– Trust and credibility: Banks are trusted institutions with a long-standing reputation. Their entry into the crypto space could instill confidence in potential investors who are skeptical about the legitimacy of crypto exchanges.

– Integration with traditional banking services: Banks could offer seamless integration between traditional banking services and cryptocurrency transactions, making it easier for individuals to manage their finances.

5. What challenges might banks face in replacing crypto exchanges?

– Technological adaptation: Banks would need to invest in advanced technology infrastructure to support cryptocurrency transactions and ensure a smooth user experience.

– Regulatory hurdles: The regulatory landscape surrounding cryptocurrencies is still evolving. Banks would need to navigate through complex regulations to ensure compliance.

– Competition from existing exchanges: Crypto exchanges have already established a significant user base and offer a wide range of services. Banks would need to offer compelling advantages to attract users away from these established platforms.

6. What are the potential implications for the crypto market?

If banks were to replace crypto exchanges, it could lead to increased mainstream adoption of cryptocurrencies. The involvement of trusted financial institutions could attract institutional investors and individuals who were previously hesitant to enter the crypto market. This could potentially drive up the value of cryptocurrencies and contribute to their long-term stability.

Expert Insights

To gain further insights into this topic, we reached out to renowned crypto expert, [Expert Name]. According to [Expert Name], “The entry of banks into the crypto market could bring much-needed credibility and regulatory oversight. However, it remains to be seen how banks will adapt to the unique challenges posed by cryptocurrencies.”

Conclusion:

The possibility of banks replacing crypto exchanges is an intriguing development in the world of cryptocurrencies. While there are potential benefits, such as enhanced security and regulatory compliance, banks would also face significant challenges in adapting to the crypto market. The involvement of trusted financial institutions could have a profound impact on the mainstream adoption of cryptocurrencies and their long-term stability. As the crypto market continues to evolve, it will be fascinating to see how banks and crypto exchanges coexist and shape the future of digital assets.

Good morning

First

🙏🙏🙏

Lovely…. Fantastic 👌

सब कुछ अच्छा होने वाला हैं, आसनसोल से crypto में 2017 से हु और बहुत अच्छा कर रहा हु

Pepe coin update

5 coin list dalo sir

Kya arb,sui aur matic ka dip lg Chuka hai

Dot coin saport bolo dada

Bull run confirm by these events 🚀

Sir aap halke kyun ho rhe day by day

🎉

Bhai matic buy krne ke liye kb tk wait kre

Good 👍

cool loking bhai

Yes

crypto currency feature hai sir

hey bro

aap din ba din patle ho chuke ho

aisa kyon ?

market ke bajase ya fir khana kam khate ho,

maito mota ho gaya tensan mai kha kha kar🤪🤑🤑

Pankaj bhai you looks younger now a days❤

Thanks bhi nice information

❤❤

🙏

good analysis bhaiya,, pr saare log ye sb sun kr bull run chik chilla rhe , isse bull run nhi ane wala, market me jb ek jhtka milega or sb hope loose kr denge tb reversal aega bull run ke liye

Keep building 🏢 ignore 4😅😅

❤

sip p video bnaay sir

Everything would be great❤

Maal btora ja rha hai 😁😂

Last time Elon Musk tha as a whale

Very nice video

You are always an energetic sir bear or bull always positive

Me aaj bhi Manta hu 20000 tk jayega

Very nice

❤❤❤❤

Thanks bhai

Very nice sir😊

Hotbit kyu band ho gya

Btc crash this week or btc 17000 hazar per chla jya ga is week me 😢