Day Trading

Embarking on the exhilarating journey of day trading cryptocurrencies demands both skill and adaptability. The volatile nature of the crypto market makes it a challenging but rewarding realm to navigate, requiring traders to employ effective strategies to seize opportunities and manage risks effectively.

We delve into the world of crypto day trading, exploring the most successful strategies by curating the best resources that can enhance your trading prowess. Whether you’re a seasoned trader seeking to fine-tune your approach or a newcomer venturing into the exciting world of day trading, get ready to immerse yourself in the fast-paced arena of cryptocurrency trading. By equipping yourself with these powerful strategies, you can maximize your gains and thrive amidst the dynamic landscape of digital finance. Let’s delve in and unlock the secrets to successful crypto day trading!

"Quote That"

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

This quote emphasizes the importance of understanding the true value of assets rather than solely focusing on short-term price fluctuations, a key lesson for day traders who seek to make informed investment decisions.

“In investing, what is comfortable is rarely profitable.” – Robert Arnott

Day trading often involves taking calculated risks and stepping outside of one’s comfort zone to seize opportunities in the market. This quote serves as a reminder that successful day trading may require embracing uncertainty and being willing to act decisively.

What Is Crypto Day Trading?

Crypto day trading revolves around the trader’s aim to execute trades within the same day, encompassing the intraday or one-day time horizon. This real-time interaction with price dynamics is pivotal for day traders. The strategy employed during this time frame will dictate how traders engage with the market.

Typically, day traders seek out smaller price movements by analyzing intraday market behavior. This approach allows them to adopt tighter risk parameters compared to longer time frames and adjust their allocation size accordingly. Since the expected movements are smaller, day traders can execute larger trades while still managing risk effectively. Furthermore, the absence of overnight holds in day trading eliminates the risk associated with market fluctuations during extended periods.

In essence, crypto day trading demands nimbleness and precision, enabling traders to seize opportunities in real-time and make informed decisions throughout the trading day. By understanding the intricacies of this time horizon and deploying appropriate strategies, day traders can navigate the crypto market with confidence and achieve their financial goals.

Momentum trading is a dynamic strategy that allows traders to profit from short-term price trends in financial markets. By identifying assets with significant recent price movement, momentum traders aim to ride these trends for potential profits, irrespective of overall market direction. This introductory guide explores the core principles behind momentum trading, the tools used to spot opportunities, and the associated benefits and risks. While momentum trading can be rewarding, traders must exercise caution and implement risk management strategies to make informed decisions and navigate the complexities of the financial markets effectively.

What is Momentum Trading?

It focuses on identifying short-term price trends and capitalizing on the momentum exhibited by digital assets to potentially generate profits. In momentum trading for cryptocurrencies, traders look for coins or tokens that have recently experienced significant price movements, either upward or downward. The idea is that strong price movements are likely to continue in the same direction for a certain period, creating opportunities for profitable trades. Traders aim to enter positions when they detect a strong momentum pattern and exit before the trend reverses or loses steam.

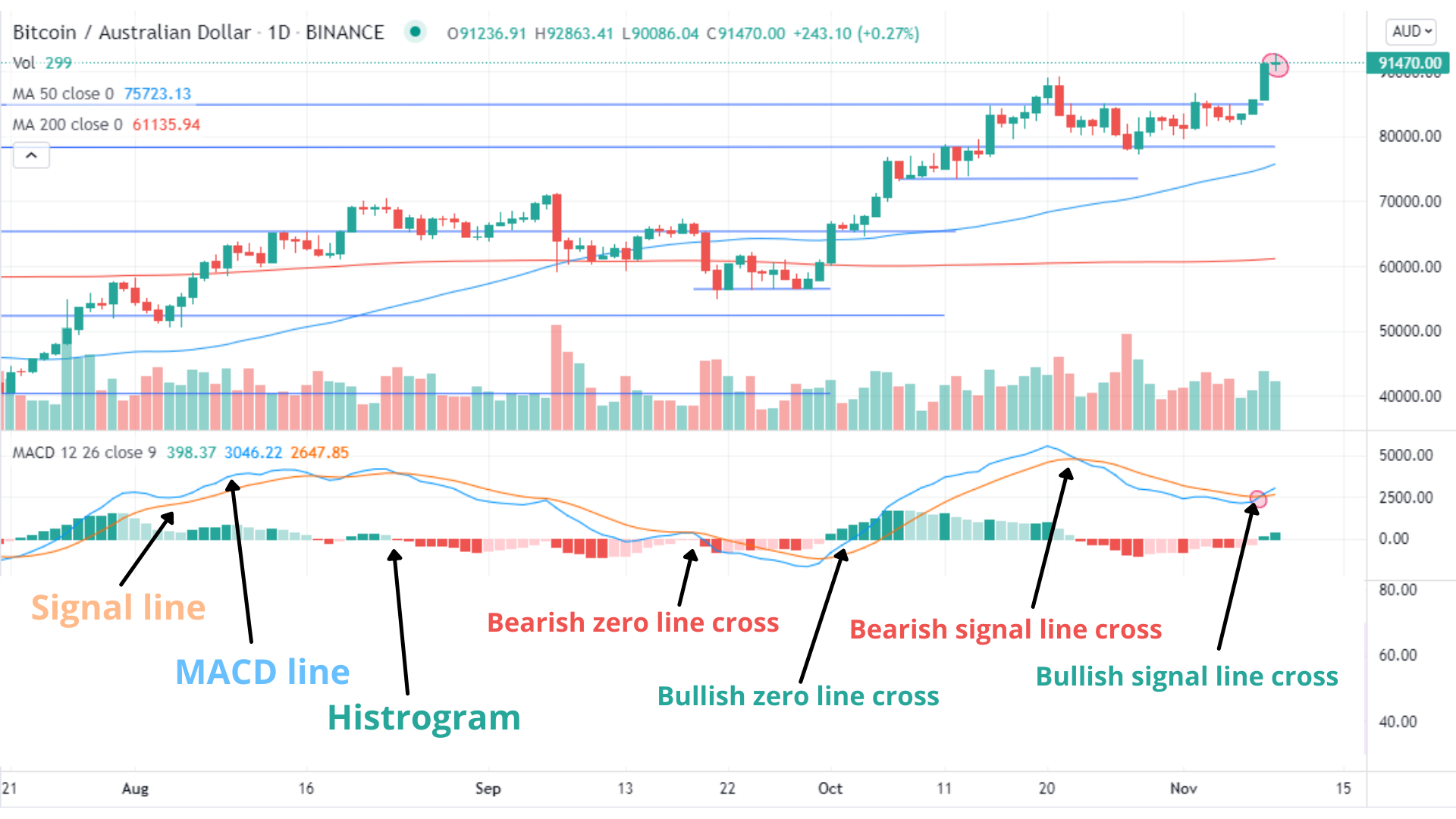

To identify momentum opportunities in the cryptocurrency market, traders often use technical analysis tools and indicators. Popular indicators like Moving Averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence) can help assess the strength and direction of the price trend, assisting traders in making informed decisions.

It’s important to note that while momentum trading in crypto can be potentially rewarding due to the market’s high volatility, it also comes with increased risks. Cryptocurrencies are known for their wild price swings, and markets can be heavily influenced by news, social media trends, and regulatory developments. As a result, momentum traders in the crypto space must exercise caution, apply risk management strategies, and stay up-to-date with the latest market news and trends to make calculated and profitable trades.

Key Elements

Momentum investing requires careful evaluation of a trend’s strength before initiating a trade to effectively manage risks amidst market volatility, price fluctuations, and potential momentum shifts. This strategy relies on analyzing three crucial metrics:

The trading volume indicates the number of traders participating in a trend within a specific timeframe, based on the volume of assets traded. High trading volume suggests a healthy and robust trend with significant momentum, although it’s essential to be cautious of potential manipulations by large traders.

Momentum traders seek out volatile markets, such as cryptocurrencies like BTC and ETH, to profit from short-term price fluctuations. However, precise timing for entering and exiting trades is crucial, as market conditions can change rapidly.

The chosen timeframe plays a pivotal role in momentum trading. Traders must align their analysis with a specific timeframe since a trend’s significance is relative to that period. For instance, while Bitcoin’s price might increase on an hourly chart, it could be a temporary swing amidst a larger decline. Stronger momentum is observed when multiple timeframes corroborate the same trend direction.

By considering these key elements, momentum traders can make informed decisions and increase their chances of successfully capitalizing on short-term price movements in the financial markets.

Fun Facts

The term “momentum trading” originated from Sir Isaac Newton’s First Law of Motion, which states that an object in motion tends to stay in motion unless acted upon by an external force. This concept of inertia and motion inspired the application of momentum in finance.

Momentum traders often observe the “January Effect,” a phenomenon where certain stocks experience a surge in prices during January, leading to potentially profitable opportunities for those employing momentum strategies at the beginning of the year.

Traders who focus on momentum strategies are sometimes referred to as “momentum chasers” or “trend followers” due to their habit of entering trades that align with the prevailing price trends.

"Quote That"

“The trend is your friend.”

This famous quote emphasizes the significance of following market trends and aligning trading strategies with momentum to increase the likelihood of profitable trades.

“Buy high and sell higher.”

This quote captures the essence of momentum trading, where traders seek to enter positions in assets that have already exhibited strong price movement, anticipating further upward momentum for potential gains.

Best Momentum Indicators

The choice of the “best” momentum indicators can vary depending on a trader’s preferences, trading style, and the specific financial market being analyzed. Different indicators may complement each other, providing a more comprehensive picture of market momentum. Here are some popular momentum indicators often used by traders.

MACD is a versatile indicator that combines moving averages to identify changes in momentum. It consists of the MACD line (the difference between two exponential moving averages) and the signal line (a moving average of the MACD line). Bullish and bearish crossovers between these lines can signal potential buying or selling opportunities.

RSI measures the speed and change of price movements and helps identify overbought and oversold conditions. It oscillates between 0 and 100, and values above 70 indicate overbought levels, while values below 30 indicate oversold levels. Traders look for potential trend reversals when RSI reaches extreme levels.

Similar to RSI, the stochastic oscillator also helps identify overbought and oversold conditions. It compares an asset’s closing price to its price range over a specific period. Readings above 80 indicate overbought levels, while readings below 20 indicate oversold levels.

ATR measures market volatility by calculating the average range between high and low prices over a specified period. Traders use ATR to determine potential stop-loss and take-profit levels based on current market volatility.

CCI measures the deviation of an asset’s price from its statistical average. It helps identify potential trend reversals or overbought/oversold conditions.

The momentum indicator calculates the difference between the current closing price and the closing price “n” periods ago. Positive values indicate upward momentum, while negative values indicate downward momentum.

This comprehensive indicator provides information about support, resistance, and trend direction. It consists of five lines: Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and the Chikou Span.

Bollinger Bands consist of a middle moving average line and two outer bands that represent standard deviations from the average. The bands expand during periods of high volatility and contract during low volatility. Traders use them to identify potential breakouts and price trends.

ROC measures the percentage change in price over a specific period. It helps identify the rate at which an asset’s price is accelerating or decelerating.

Remember, no single indicator is foolproof, and traders often use a combination of indicators to confirm signals and gain a more comprehensive understanding of market momentum. Additionally, it’s essential to consider the overall market context and practice proper risk management while using momentum indicators.

Momentum Trading Risk Management

Momentum trading, with its focus on short-term price trends, can be a rewarding strategy for capturing quick profits in the financial markets. However, it also carries inherent risks due to the market’s high volatility and rapid price movements. Implementing effective risk management strategies is crucial for preserving capital and safeguarding profits in momentum trading. Here are key risk management practices to consider:

Determining the appropriate size of each trade relative to the overall trading capital is essential. By allocating a reasonable percentage of the capital to any single trade, traders can minimize the impact of potential losses on their portfolio.

Setting stop-loss orders is a fundamental risk management tool. A stop-loss order establishes a predetermined exit point for a trade, automatically closing the position if the asset’s price moves against the trader beyond a specified level. This helps limit potential losses and prevent emotional decision-making.

Alongside stop-loss orders, take-profit orders are equally important. A take-profit order allows traders to secure profits by automatically closing the position when the asset’s price reaches a pre-determined favorable level. Taking profits at appropriate levels can protect gains and prevent potential reversals from eroding profits.

Spreading investments across different assets or markets can mitigate risks associated with individual assets. Diversification reduces the impact of any single asset’s price movement on the overall portfolio, helping to balance potential losses.

Evaluating the risk-reward ratio before entering a trade is crucial. A favorable risk-reward ratio ensures that the potential profit from a successful trade outweighs the potential loss if the trade is unsuccessful. Traders often aim for a positive risk-reward ratio to improve overall profitability.

Momentum trading can be tempting due to the frequent opportunities it presents, but overtrading can lead to increased transaction costs and emotional stress. Sticking to a well-defined trading plan and avoiding impulsive decisions is essential for long-term success.

Financial markets are dynamic, and momentum patterns can change quickly. Staying informed about market developments, news, and emerging trends can help traders adapt their strategies accordingly.

Emotions can cloud judgment and lead to impulsive decisions. Maintaining emotional discipline and adhering to a trading plan can prevent rash actions that may lead to avoidable losses.

Before implementing a momentum trading strategy, traders should conduct backtesting using historical data to assess the strategy’s performance under different market conditions. This evaluation can help identify potential weaknesses and refine the approach.

By incorporating these risk management practices into their momentum trading strategies, traders can increase their chances of navigating the volatile market successfully while safeguarding their capital and profits.

Pros

Momentum trading offers the potential for quick and substantial profits by capitalizing on short-term price trends. Successful trades can yield attractive returns within a relatively short period.

This strategy aligns with the adage “the trend is your friend.” Momentum traders ride established trends, increasing the likelihood of being on the right side of market movements.

Momentum trading thrives in volatile markets, as it leverages rapid price movements to generate profits. Cryptocurrencies and certain stocks, which can exhibit high volatility, are well-suited for this approach.

Momentum indicators provide clear signals for potential entry and exit points, making it easier for traders to execute their trades with precision.

Momentum traders often benefit from positive reinforcement as winning trades reinforce their confidence and discipline, leading to better decision-making.

Cons

Momentum can reverse abruptly, leading to losses for traders who fail to exit positions at the right time. Quick price fluctuations can make it challenging to accurately predict trend reversals.

Volatile markets can produce a significant amount of noise, leading to false signals from momentum indicators, which may result in misguided trades.

Momentum trading involves frequent trading, which can lead to increased transaction costs, such as commissions and spreads, potentially eating into profits.

The fast-paced nature of momentum trading can cause emotional stress for traders, especially during periods of high volatility. Fear and greed can influence decision-making, leading to impulsive actions.

Momentum trading is primarily geared towards short-term gains, and traders may miss out on longer-term investment opportunities by solely focusing on short-term price movements.

Successful momentum trading demands a combination of skill, experience, and discipline. Novice traders may find it challenging to accurately identify and time momentum opportunities.

Identifying the precise entry and exit points can be difficult, and mistimed trades may result in missed profit opportunities or increased losses.

Final Thoughts

Momentum trading as a strategy for day trading offers a dynamic and exhilarating approach to capitalize on short-term price trends in the financial markets. By identifying assets with strong momentum and swift price movements, day traders can potentially achieve significant profits within a single trading day. However, the strategy’s rapid pace introduces risks of sudden reversals and false signals, demanding disciplined risk management and emotional control. Successful momentum trading requires a combination of skill, experience, and continuous learning, enabling day traders to thrive in the fast-moving markets and harness the strategy’s potential for financial success.

Welcome to the fast-paced world of High-Frequency Trading (HFT), where speed is paramount and opportunities flicker by in the blink of an eye. HFT is a cutting-edge trading technique that leverages advanced algorithms to seize minuscule price fluctuations and disparities across multiple exchanges. With lightning-fast execution, HFT platforms can open and close multiple positions within seconds, aiming to capitalize on fleeting market movements that might go unnoticed by traditional traders.

This guide will explore the intricacies of High-Frequency Trading, exploring how it operates and its evolution into the realm of cryptocurrencies. We will delve into the strategies employed, the risks involved, and the impact of HFT on crypto. Moreover, we will examine how institutional investors utilize this lightning-speed approach and the potential benefits and pitfalls it presents.

Whether you are a seasoned trader seeking to enhance your knowledge or a curious newcomer eager to understand the mechanics behind HFT, this guide aims to equip you with the insights needed to navigate the captivating world of High-Frequency Trading.

What Is High-Frequency Trading (HFT) In the Crypto Market?

High-Frequency Trading (HFT) in the crypto market is a sophisticated trading strategy that revolves around speed and precision. Utilizing advanced algorithms and powerful computing systems, HFT seeks to capitalize on rapid price movements and arbitrage opportunities within the cryptocurrency landscape. The essence of HFT lies in its ability to execute multiple trades within fractions of a second, exploiting even the slightest price disparities across various cryptocurrency exchanges.

In the crypto market, HFT platforms analyze real-time market data to detect fleeting opportunities that might elude traditional traders. By swiftly opening and closing positions, HFT aims to profit from short-term price discrepancies, taking advantage of the highly volatile nature of cryptocurrencies. However, HFT in the crypto market requires not only cutting-edge technology but also a deep understanding of the intricacies of digital assets and the ability to navigate the market’s dynamic landscape. While HFT has the potential to yield significant profits, it also carries inherent risks, necessitating careful risk management and a thorough understanding of the trading environment.

How Does High-Frequency Trading Work?

High-Frequency Trading (HFT) operates at an extraordinary pace, leveraging advanced technology and algorithmic strategies to execute trades within microseconds. At its core, HFT seeks to profit from minuscule price discrepancies and fleeting opportunities in the financial markets. The process begins with HFT firms utilizing sophisticated algorithms to analyze real-time market data, tracking price movements, volume, and order flow across various exchanges. These algorithms swiftly identify patterns, trading signals, and arbitrage opportunities, allowing HFT platforms to make split-second decisions on whether to buy, sell, or remain neutral on a particular asset.

Once a trading signal is detected, HFT systems rapidly execute the trade, often in fractions of a second, to capitalize on the fleeting advantage. To achieve such unprecedented speed, HFT firms often colocate their servers in close proximity to the exchanges’ data centers, minimizing network latency and gaining a competitive edge. Additionally, HFT relies on direct market access (DMA) to bypass traditional intermediaries, ensuring rapid order execution without delays caused by manual intervention.

HFT strategies encompass various approaches, such as market-making, liquidity provision, statistical arbitrage, and event-driven trading. Despite the complex and lightning-fast nature of HFT, its implementation necessitates stringent risk management and constant monitoring to address potential issues promptly. While HFT can generate significant profits through high trading volumes and tight spreads, it also faces regulatory scrutiny and requires substantial investment in technology and research to remain competitive in the ever-evolving financial landscape.

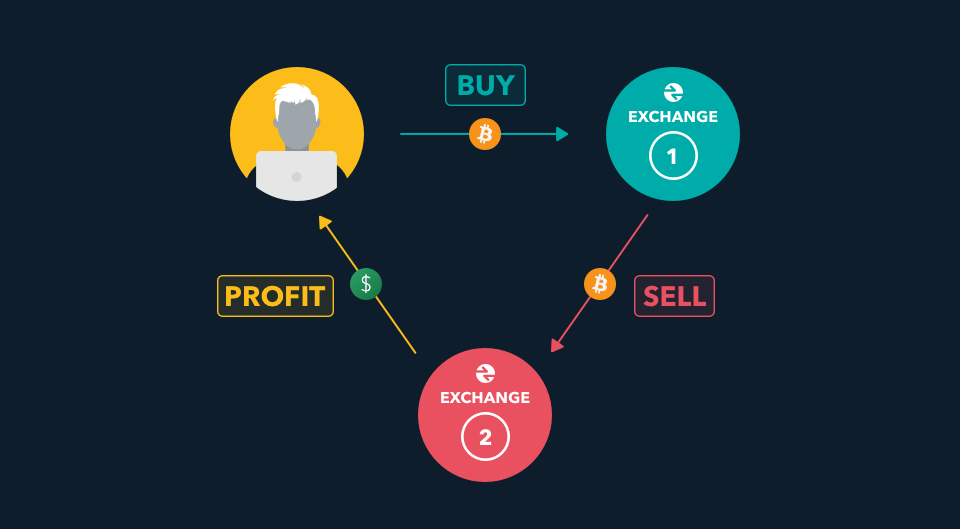

An example of High-Frequency Trading (HFT) in the cryptocurrency market could involve arbitrage opportunities between different cryptocurrency exchanges. Let’s consider a scenario where Bitcoin (BTC) is being traded on Exchange A and Exchange B simultaneously.

At a particular moment, the price of Bitcoin on Exchange A is slightly higher than on Exchange B due to varying demand and liquidity conditions. An HFT platform with advanced algorithms detects this price discrepancy within milliseconds.

The HFT platform swiftly executes a buy order for Bitcoin on Exchange B, where it’s cheaper, and simultaneously places a sell order for Bitcoin on Exchange A, where it’s more expensive. The HFT platform profits from the price difference, also known as the arbitrage spread, and the trade is completed almost instantaneously.

This process can be repeated multiple times in a fraction of a second, generating small but frequent profits from these arbitrage opportunities. HFT firms often execute thousands of such trades throughout the trading day, relying on speed and precision to capitalize on these fleeting market inefficiencies.

It’s essential to note that HFT in the cryptocurrency market demands cutting-edge technology and direct access to market data, enabling rapid execution and a competitive advantage in capturing these arbitrage opportunities. Additionally, regulatory compliance and risk management remain crucial considerations in HFT operations to ensure fair trading practices and market stability.

How to use High-Frequency Trading in Crypto

To execute trades at lightning speed, you need a robust and low-latency infrastructure. Co-locating your servers close to the cryptocurrency exchanges is crucial to minimize network latency and gain a competitive edge. Direct market access (DMA) is also essential to bypass intermediaries and achieve faster order execution.

Develop sophisticated algorithms capable of analyzing real-time market data, including price, volume, and order flow, from multiple cryptocurrency exchanges. These algorithms should be designed to detect patterns, trading signals, and arbitrage opportunities in fractions of a second.

Thoroughly backtest your algorithms using historical data to evaluate their performance and refine them for optimal results. Continuously optimize your algorithms to adapt to changing market conditions and improve trading strategies.

Implement stringent risk management protocols to protect your capital from significant losses. This may include setting strict stop-loss orders, position sizing, and monitoring for any technical issues that may impact your trading operations.

Consider incorporating market-making strategies to provide liquidity to the crypto market. By continuously offering bids and asks, you can contribute to smoother market operations and potentially profit from the bid-ask spread.

Be aware of regulatory requirements in the jurisdictions where you operate. HFT is subject to specific regulations, and adherence to these rules is crucial to ensure fair trading practices and market integrity.

Conduct extensive testing in a simulated environment to validate the performance of your HFT strategies. Continuously monitor your trading operations in real-time to ensure that your algorithms are functioning as expected.

Choose cryptocurrency exchanges with reliable APIs and robust connectivity to ensure seamless trade execution. Consider working with multiple exchanges to access a broader range of trading opportunities.

The cryptocurrency market is highly dynamic, and HFT strategies need to adapt quickly to changing market conditions. Stay informed about market developments and continuously refine your algorithms to remain competitive.

High-Frequency Trading demands substantial capital and resources to invest in cutting-edge technology, data analysis, and research. Be prepared to allocate significant resources to run your HFT operations effectively.

Fun Facts

- High-Frequency Trading has become so fast that traders started considering the speed of light as a limiting factor. In Michael Lewis’s book “Flash Boys,” it was revealed that traders were exploring the option of laying fiber-optic cables in straight lines from Chicago to New Jersey to gain a few microseconds advantage by reducing the distance of data transmission. This demonstrates the extraordinary lengths to which HFT firms go to gain a competitive edge in the lightning-fast world of trading.

- High-Frequency Trading has been compared to some of the fastest creatures in nature. For instance, a study by the UK’s Office of National Statistics found that HFT algorithms executing a trade can be faster than the time it takes for a human eye to blink. Similarly, some have humorously compared the reaction times of HFT algorithms to those of a striking rattlesnake, showcasing the incredible speed and efficiency of these automated trading systems.

Applying HFT in crypto markets requires significant expertise, technological sophistication, and adherence to regulatory guidelines. Success in HFT trading relies on continuous innovation, rigorous testing, and the ability to seize fleeting opportunities in the fast-paced world of cryptocurrency trading.

Pros

HFT allows traders to execute multiple trades within fractions of a second, enabling them to capitalize on rapid price movements and take advantage of short-term opportunities in the highly volatile crypto market.

HFT in crypto day trading can identify price discrepancies across different exchanges and quickly execute trades to profit from arbitrage opportunities, thereby maximizing potential gains.

HFT traders often act as market-makers, providing liquidity to the crypto market. This liquidity provision helps enhance market efficiency and reduces bid-ask spreads, benefiting all market participants.

HFT relies on advanced algorithms to analyze real-time market data, allowing traders to make informed decisions based on the most current information available.

HFT platforms can continuously monitor the crypto market, providing traders with immediate access to emerging trends and opportunities throughout the trading day.

Cons

HFT is a complex and highly automated trading technique that has faced regulatory scrutiny in traditional financial markets. In the crypto space, regulators may closely monitor HFT practices to ensure fair trading and market integrity.

Setting up the required low-latency infrastructure and accessing high-quality data feeds can be expensive, requiring significant initial investment and ongoing maintenance costs.

The crypto market attracts numerous HFT firms, leading to intense competition. Traders must compete for the same opportunities, potentially reducing the profitability of HFT strategies.

HFT systems are susceptible to technical glitches, and even a small malfunction can lead to significant losses. Proper risk management and redundant systems are essential to mitigate this risk.

HFT in crypto day trading primarily focuses on short-term trades and small profit margins. Traders may miss out on potential long-term trends and investment opportunities by solely relying on rapid, intraday trading.

In highly liquid markets like cryptocurrencies, large HFT trades can sometimes impact market stability and contribute to short-term price fluctuations.

Conclusion

High-Frequency Trading (HFT) offers enticing prospects for day trading cryptocurrencies, leveraging speed and efficiency to seize fleeting market opportunities. The ability to execute multiple trades within milliseconds empowers traders to capitalize on rapid price movements and take advantage of arbitrage opportunities across various exchanges. Real-time data analysis and continuous market monitoring enhance decision-making, providing valuable insights throughout the trading day. However, the implementation of HFT in crypto day trading requires substantial investment in low-latency infrastructure and advanced algorithms. Traders must also navigate the challenges of regulatory scrutiny and heightened competition in the dynamic and highly volatile crypto market.

While HFT holds the promise of maximizing profits in the short term, traders must remain cautious about the risk of technological glitches, which could lead to substantial losses. Robust risk management practices and redundant systems are essential safeguards in this fast-paced environment. Moreover, traders should strike a balance between HFT strategies and other trading approaches to ensure a well-rounded and adaptable trading strategy. Ultimately, success in using HFT for crypto day trading lies in a comprehensive understanding of the market, strategic planning, and the ability to adapt to the ever-changing crypto landscape.

Scalping day trading in the cryptocurrency market is a fast-paced and dynamic strategy that focuses on capturing small price movements within a single trading day. As a form of intraday trading, scalpers execute numerous trades throughout the day, aiming to profit from even the slightest price fluctuations. In this introductory guide, we will explore the core principles of scalping day trading in crypto, the tools and techniques employed by scalpers, and the advantages and challenges of adopting this high-speed approach. By the end, you’ll have a clearer understanding of how scalping can offer rapid profit opportunities in the ever-evolving world of cryptocurrency trading.

What Is Scalp Trading in Crypto?

Scalping in crypto is a fast-paced day trading strategy that seeks to profit from small price movements in the cryptocurrency market. Traders employing this approach execute numerous rapid trades, holding positions for just seconds to minutes, and capitalizing on the bid-ask spread—the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. By exploiting these tiny price differentials, scalpers aim to accumulate multiple small gains throughout the day.

Effective crypto scalping relies on using technical analysis tools and indicators, such as moving averages, MACD, RSI, and short-term chart patterns, to identify optimal entry and exit points for swift trades. However, the strategy demands quick decision-making, discipline, and the ability to act swiftly in the face of the cryptocurrency market’s inherent volatility. Traders should be mindful of transaction costs, including trading fees and potential slippage, as they can impact overall profitability. Given its intense nature, crypto scalping is typically best suited for experienced traders who can adeptly manage the challenges and risks associated with this high-frequency trading strategy.

Crypto scalping strategies

Crypto scalping strategies apply the principles of scalp trading to the cryptocurrency market, aiming to profit from rapid price movements in digital assets. These are the most successful strategies:

This strategy involves identifying key support and resistance levels on the price chart, which are areas where the price tends to bounce or reverse. Traders enter positions when the price bounces off the support level or breaks through the resistance level, aiming to profit from these predictable price movements within the established price range.

Breakout scalpers focus on trading the price breakouts that occur when the price moves above a resistance level or below a support level. Traders enter positions as soon as the breakout occurs, expecting the price to continue in the direction of the breakout and quickly capturing profits.

Fading scalpers take contrarian positions, betting against short-term price trends. They look for overbought conditions (near resistance) or oversold conditions (near support) and execute trades when the market is expected to reverse. Fading scalping requires precise timing, as traders aim to catch the turning points in the price movement.

Momentum scalping involves identifying assets with strong momentum and executing trades in the direction of the prevailing trend. Traders use technical indicators like Moving Average Convergence Divergence (MACD) or Relative Strength Index (RSI) to identify assets with significant momentum. The goal is to capture quick profits as the trend continues before it potentially reverses.

Time-based scalping relies on executing trades at specific times of the day when market volatility tends to be higher. Traders may focus on opening positions during key economic data releases, market openings, or overlapping trading sessions to take advantage of predictable price movements during these times.

Range scalping is suitable for assets that are trading within a well-defined price range. Traders identify the upper and lower boundaries of the range and execute trades at these levels. They aim to profit from price fluctuations within the established boundaries, often buying at the support level and selling at the resistance level.

Traders use moving averages (MA) to identify short-term trends and potential entry and exit points. For example, a trader may enter a long position when the price crosses above a short-term MA and exit the trade when it crosses below the MA.

Tick scalping involves using tick charts, which measure each individual trade’s price movement, rather than time-based charts. Traders monitor tick data to identify short-term price movements and execute rapid trades based on these movements.

Arbitrage scalpers take advantage of price discrepancies between different exchanges or markets. They buy an asset at a lower price on one exchange and sell it at a higher price on another exchange, profiting from the price difference.

Traders use Fibonacci retracement levels to identify potential entry and exit points for rapid trades. Fibonacci retracement levels are based on key price levels, and traders use these levels to determine where the price is likely to bounce or reverse.

Each scalp trading strategy requires a deep understanding of the market, technical analysis tools, and precise execution. Traders may combine elements from multiple strategies or develop their unique approach based on their trading style and the specific market conditions they encounter. Successful scalp trading also relies on strict risk management practices to protect capital and ensure consistent profitability. As with any trading strategy, traders should continuously learn and adapt to market conditions to improve their scalp trading skills.

Best Time Frame for Scalping

The best time frame for scalping in the cryptocurrency market is typically short, focusing on very brief price movements. Scalpers aim to capture small profits from rapid price fluctuations, and as such, they often use time frames ranging from seconds to minutes. The most common time frames for crypto scalping include:

The 1-minute chart is widely used by scalpers as it provides a high level of granularity, allowing traders to spot quick price movements and make rapid trading decisions.

Some scalpers prefer the 3-minute chart as it provides a slightly broader view than the 1-minute chart, which can help reduce noise and provide a clearer picture of short-term price trends.

The 5-minute chart is another popular choice for scalpers. It offers a balance between the granularity of the 1-minute chart and the broader perspective of longer time frames.

The choice of the best time frame for scalping can vary depending on the individual trader’s preference, trading style, and the specific cryptocurrency being traded. Some scalpers may even use multiple time frames simultaneously to get a comprehensive view of the market and confirm their trading signals.

It’s important to note that scalping requires a high level of focus and quick decision-making, so traders should select a time frame that aligns with their trading skills and comfort level. Additionally, traders should consider the market’s liquidity and volatility during the chosen time frame, as these factors can impact the execution of scalping trades.

Fun Facts

Scalp trading has historical roots dating back to the 1800s when it was practiced in the commodity markets, particularly in the trading of wheat and corn.

In the early days of stock exchanges, scalpers physically operated on the trading floor, using hand signals and quick movements to execute rapid trades.

In popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), the combined daily scalp trading volume can be in the billions of dollars.

How to set up a crypto scalping trading strategy?

Setting up a crypto scalping trading strategy requires careful planning, technical analysis, and a disciplined approach. Here are the steps to establish a successful crypto scalping trading strategy:

Select a reputable cryptocurrency exchange with high liquidity and low trading fees. Scalpers need fast and efficient order execution, so the exchange’s platform should be user-friendly and responsive.

Determine your trading goals, such as daily profit targets and maximum acceptable losses. Scalping involves frequent trading, so it’s crucial to have a clear understanding of your risk tolerance and financial objectives.

Look for cryptocurrencies with high volatility and trading volume, as they offer more frequent price movements and narrower bid-ask spreads, making them suitable for scalping.

Utilize technical analysis indicators to identify short-term price trends and potential entry and exit points. Popular indicators for scalping include Moving Averages, Relative Strength Index (RSI), and MACD.

Implement stop-loss orders to limit potential losses in case a trade moves against you. Additionally, use take-profit orders to secure profits when your predefined profit targets are met.

Keep a close eye on bid-ask spreads, as narrower spreads enhance profitability for scalping trades. Choose assets with tighter spreads for your trading pairs.

Create a well-defined trading plan that includes specific entry and exit criteria, risk management rules, and a clear schedule for trading sessions. Stick to your plan and avoid making impulsive decisions.

Begin with small position sizes to reduce risk while you gain experience and confidence in your scalping strategy.

Before trading with real money, practice your scalping strategy on a demo account provided by the exchange or a trading platform. This allows you to refine your approach without risking actual funds.

Scalping requires constant monitoring of the market, as opportunities can arise and vanish quickly. Stay vigilant and be prepared to act swiftly.

Maintain a trading journal to record your trades, strategies, and outcomes. This will help you analyze your performance, identify strengths and weaknesses, and make improvements.

Remember that scalping involves frequent and rapid trades, so it requires a high level of focus, discipline, and emotional control. Be prepared for the fast-paced nature of scalping and continuously refine your strategy based on real-time market data and performance analysis. As with any trading strategy, there are risks involved, so it’s essential to only trade with capital you can afford to lose and seek professional advice if needed.

Pros

Scalping generates numerous trading opportunities throughout the day, allowing traders to capture small profits from multiple trades.

Scalping provides an exciting and dynamic trading experience, appealing to traders who enjoy quick decision-making and rapid execution.

Scalpers typically close all their positions by the end of the trading day, reducing exposure to overnight market risks.

Scalping takes advantage of short-term price fluctuations and volatility, making it well-suited for highly volatile markets like cryptocurrencies.

Since scalpers hold positions for brief periods, they are less exposed to market-moving events, such as major news releases.

Scalping may require less time compared to other trading strategies, as positions are typically held for a few seconds to minutes.

Cons

High-frequency trading involves frequent transactions, leading to increased trading fees and potential slippage, which can eat into profits.

The fast-paced nature of scalping can be mentally and emotionally taxing, requiring discipline to remain focused and avoid impulsive decisions.

The excitement of scalping can tempt traders to overtrade, leading to excessive transaction costs and increased risk exposure.

Scalping aims for small price movements, limiting the profit potential per trade compared to longer-term trading strategies.

The frequent entry and exit points in scalping mean that losses can accumulate quickly if the strategy is not executed carefully.

Scalping relies heavily on technical analysis, making traders vulnerable to false signals or sudden market shifts that may challenge the effectiveness of indicators.

Scalping demands advanced trading skills, quick decision-making, and the ability to handle stress, making it less suitable for inexperienced traders or those lacking focus and discipline.

Final Thoughts

Ultimately, the effectiveness of scalping as a trading strategy depends on the trader’s skills, risk tolerance, and the ability to adapt to the fast-paced and challenging nature of this approach. Traders considering scalping should carefully weigh the pros and cons, and always employ proper risk management techniques to protect their capital.

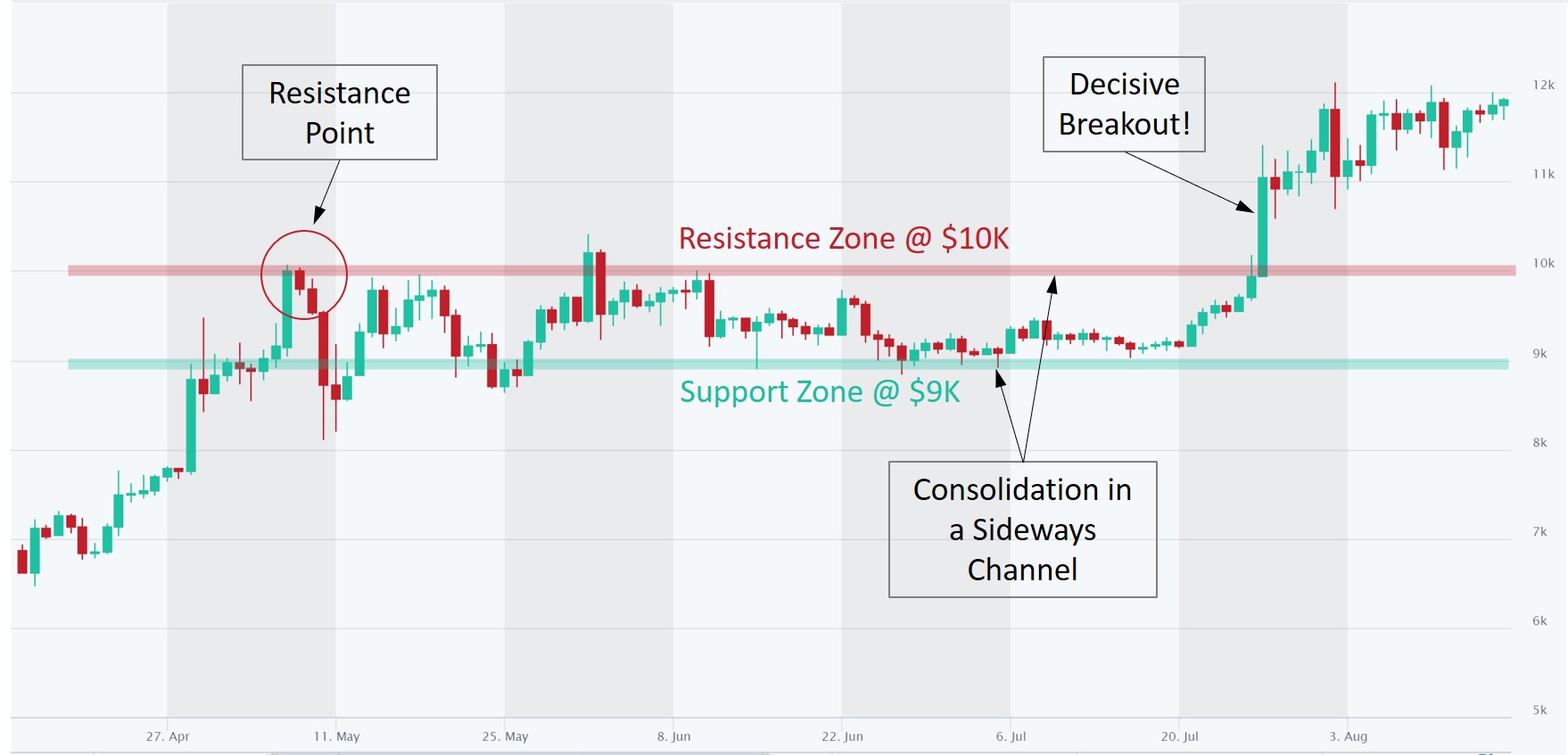

Range trading in the cryptocurrency market is a strategy that focuses on identifying and trading within well-defined price ranges. Traders executing range trading strategies aim to buy at support levels and sell at resistance levels, taking advantage of the price oscillations within the established boundaries. This approach is particularly suited for cryptocurrencies that exhibit periods of consolidation or sideways movement, allowing traders to profit from price fluctuations without relying on significant price trends. Range trading in crypto requires keen observation, technical analysis skills, and the ability to identify reliable support and resistance levels to make informed trading decisions.

What is range trading in crypto?

Range trading in crypto refers to a trading strategy where traders identify and take advantage of well-defined price ranges within a cryptocurrency’s price chart. In this strategy, traders look for periods when the cryptocurrency’s price is moving sideways or consolidating, showing clear boundaries of support and resistance. They then buy at the support level and sell at the resistance level, profiting from the price oscillations within the established range.

Range trading is particularly effective during market conditions when there is no clear trend direction, and the price is trading within a relatively stable price range. Traders can capitalize on the predictable price movements within the range without relying on significant price trends. This strategy requires precise technical analysis to identify reliable support and resistance levels and a disciplined approach to execute trades at the right moments. It is essential to consider the historical price data and monitor the asset’s price action to effectively implement range trading in the dynamic and volatile cryptocurrency market.

When Should You Use a Range Trading Strategy?

You should consider using a range trading strategy in the following situations:

Range trading is most effective when the cryptocurrency market is moving sideways or consolidating, with no clear trend direction. In such market conditions, the price tends to oscillate within well-defined support and resistance levels, providing opportunities for range traders to profit from short-term price fluctuations.

Before employing a range trading strategy, ensure that the price chart exhibits clear and reliable support and resistance levels. These levels should be well-established and tested multiple times, indicating that the market participants are acknowledging and reacting to them.

Range trading is suitable when market volatility is relatively low. High volatility can lead to unpredictable price movements that may break the range, making range trading less effective during such periods.

Range trading involves shorter holding periods compared to trend-following strategies, making it a viable option for traders with limited time availability.

Range trading requires accurate technical analysis to identify reliable support and resistance levels. Traders should possess the ability to read price charts, use technical indicators, and analyze price action effectively.

A disciplined approach to risk management is crucial in range trading. Set tight stop-loss orders just outside the range to limit potential losses if the price breaks out unexpectedly.

Range trading may involve waiting for the right entry and exit points, and it requires patience and discipline to execute trades only when the price is within the established range.

It’s important to note that market conditions can change rapidly, and ranges can break down due to various factors, such as significant news events or shifts in market sentiment. As such, range traders should always stay vigilant, monitor market developments, and be ready to adapt their strategies when necessary. Additionally, range trading is just one of many trading approaches, and traders should consider their risk tolerance, experience level, and market outlook when choosing a suitable strategy for their cryptocurrency trading activities.

Best Time Frame for Range Trading

The choice of timeframes for range trading can vary depending on the trader’s preference, trading style, and the specific cryptocurrency being traded. Range trading can be implemented on various timeframes, and the selection depends on the trader’s ability to analyze price action and their desired holding period for trades. Here are some common timeframes used for range trading:

The 1-hour chart is popular among range traders as it provides a good balance between capturing short-term price movements and reducing noise. Traders can identify well-defined ranges and execute trades within a few hours.

The 4-hour chart allows traders to have a broader view of price action while still capturing short-term price fluctuations within the range. It may suit traders who prefer a slightly longer holding period for their range trades.

Range trading on the daily chart provides a more significant perspective on the cryptocurrency’s price movements and allows traders to capture price fluctuations over several days.

For longer-term range trading, the weekly chart can be used to identify and trade ranges that last for weeks or even months.

Traders may use multiple timeframes simultaneously to get a comprehensive view of the market and confirm their trading signals. For example, they might use the daily chart to identify the primary range and then switch to a lower timeframe like the 1-hour chart to time their entries and exits more precisely.

It’s essential to remember that the choice of timeframe should align with the trader’s trading strategy, risk tolerance, and time availability. Additionally, range trading can be complemented with other technical analysis tools and indicators to increase the effectiveness of trades. Traders should continuously assess market conditions and be flexible in adjusting their chosen timeframes to adapt to changing price dynamics in the cryptocurrency market.

"Quote That"

“The market can remain irrational longer than you can remain solvent.” – John Maynard Keynes

While range trading can be a profitable strategy, traders must be cautious and avoid overextending themselves, especially when the market’s behavior deviates from expectations.

“Amateurs look for trends; professionals trade ranges.” – Linda Bradford Raschke

This quote highlights the effectiveness of range trading when markets lack clear trends and emphasizes the importance of skillfully navigating price ranges.

How to set up a crypto range trading strategy?

Setting up a crypto range trading strategy involves several key steps to identify, analyze, and execute trades within the well-defined price range. Here’s a step-by-step guide to help you establish a range trading strategy in the cryptocurrency market:

Start by selecting cryptocurrencies that exhibit periods of sideways or consolidating price movements. Look for assets with historical price data that shows well-established support and resistance levels.

Use technical analysis tools and indicators to identify reliable support and resistance levels. Look for areas where the price has repeatedly bounced off the same levels, indicating strong support and resistance.

Once you’ve identified the support and resistance levels, determine the range by calculating the difference between the upper boundary (resistance) and the lower boundary (support).

Plan your entry points to buy near the support level and your exit points to sell near the resistance level. This is often referred to as “buy low, sell high.”

Set tight stop-loss orders just outside the range to limit potential losses in case the price breaks out of the range unexpectedly. Determine a risk-reward ratio that aligns with your risk tolerance.

Monitor the price movement within the established range and be patient for the right entry and exit signals. Be prepared to execute multiple trades within the range as price oscillates back and forth.

Consider using technical indicators, such as moving averages or oscillators, to confirm your range trading signals and avoid false breakouts.

Stay vigilant for changes in market conditions and be ready to adjust your strategy if the range breaks down or shifts. Adaptability is essential in range trading.

Stick to your pre-defined strategy and avoid emotional decision-making. Keep a trading journal to track your trades and analyze your performance regularly.

Before risking real capital, practice your range trading strategy on demo accounts to gain confidence and refine your approach.

Stay updated on market news, events, and developments that may impact the cryptocurrency market. External factors can influence the price and cause the range to break.

Remember, range trading is just one of many trading strategies, and success depends on a combination of technical analysis skills, risk management, and discipline. Always trade with an amount you can afford to lose and continuously improve your strategy based on market conditions and personal experience.

Pros

Range trading provides well-defined entry and exit points based on support and resistance levels, making it easier for traders to plan their trades and set profit targets.

Range trading is particularly effective in sideways or consolidating markets when there is no clear trend direction. Traders can still profit from price fluctuations within the established range.

Since range traders focus on short-term price movements within a limited range, they are less exposed to extreme market volatility and sudden price swings.

Traders can implement tight stop-loss orders just outside the range, helping to limit potential losses if the price breaks out of the range unexpectedly.

Price movements within a well-defined range tend to be more predictable, providing traders with a higher probability of successful trades.

Range trading involves shorter holding periods compared to trend-following strategies, making it suitable for traders with limited time availability.

Cons

Range trading may result in smaller profits compared to trend-following strategies since traders aim to capture short-term price fluctuations within the range.

Price ranges can sometimes lead to false breakouts, where the price briefly moves beyond the range before reversing back within the range, causing potential losses for traders.

In volatile markets, the price may exhibit choppy and unpredictable behavior within the range, making it challenging to execute successful range trading strategies.

During periods of consolidation, traders engaged in range trading may miss out on significant trends in other assets or financial markets.

Ranges can break down due to fundamental shifts or significant news events, leading to rapid and substantial price movements that can catch range traders off guard.

Identifying reliable support and resistance levels for range trading requires accurate technical analysis, and false readings could lead to unsuccessful trades.

Final Thoughts

- Range trading in the cryptocurrency market can be a valuable strategy for traders seeking to profit from short-term price fluctuations within well-defined boundaries. This approach allows traders to take advantage of sideways or consolidating market conditions and offers clearly defined entry and exit points based on support and resistance levels. While range trading provides the advantage of reduced exposure to market volatility and controlled risk, traders must remain cautious of false breakouts and unpredictable price behavior. By employing precise technical analysis and maintaining a disciplined approach, range trading in crypto can offer traders a viable and potentially profitable method to navigate the dynamic and ever-evolving cryptocurrency market.

Crypto arbitrage is a trading strategy that takes advantage of price differences for the same cryptocurrency or digital asset across different exchanges. In this approach, traders buy the cryptocurrency at a lower price on one exchange and simultaneously sell it at a higher price on another exchange to profit from the price discrepancy. Crypto arbitrage relies on the inefficiencies and variations in pricing among different trading platforms and requires quick execution to capitalize on these opportunities before the market corrects itself. While it can be a lucrative strategy, it requires careful monitoring, fast transaction times, and consideration of trading fees to ensure profitable outcomes.

What is crypto arbitrage?

Crypto arbitrage is a trading strategy that aims to profit from price discrepancies for the same cryptocurrency or digital asset across different exchanges or markets. In this approach, traders take advantage of the variations in the price of the cryptocurrency on different platforms. They buy the asset at a lower price on one exchange and simultaneously sell it at a higher price on another exchange, earning a profit from the price difference.

Arbitrage opportunities in the cryptocurrency market arise due to the decentralized and fragmented nature of the industry, which can lead to differences in prices for the same asset on different platforms. These price discrepancies can be short-lived, as market participants quickly exploit them, causing prices to converge. Therefore, successful crypto arbitrage requires quick execution and efficient trading to capitalize on these opportunities before they disappear.

To implement crypto arbitrage, traders need to closely monitor multiple exchanges, assess price differentials, and factor in transaction costs, such as trading fees and withdrawal fees, to ensure the potential profit outweighs the expenses. Automated trading bots and algorithms are sometimes used to enhance the speed and efficiency of executing arbitrage trades in the fast-paced cryptocurrency market. However, it is essential to be aware of the risks involved, such as market volatility and potential delays in executing trades, as they can impact the profitability of the arbitrage strategy.

Crypto Arbitrage Trading Methods?

There are several methods of crypto arbitrage trading that traders can employ to take advantage of price discrepancies across different exchanges. Each method focuses on different aspects of the trading process and requires varying levels of expertise and resources. Here are some common crypto arbitrage trading methods:

This is the most straightforward form of crypto arbitrage, where traders manually buy the cryptocurrency at a lower price on one exchange and sell it at a higher price on another exchange. Traders execute the trades sequentially to take advantage of the price difference.

Triangular arbitrage involves exploiting price discrepancies among three different cryptocurrencies or trading pairs. Traders execute a series of quick trades across three exchanges to profit from the differences in exchange rates between the currencies.

Statistical arbitrage relies on mathematical models and statistical analysis to identify trading opportunities. Traders use algorithms to monitor and analyze price movements to detect deviations from the expected values, allowing them to execute profitable trades.

This method applies to cryptocurrency derivatives markets, particularly on platforms offering perpetual swaps or futures contracts. Traders take advantage of differences in funding rates between exchanges, which can provide an opportunity for profitable trades.

Inter-exchange arbitrage involves taking advantage of price differences for the same cryptocurrency listed on different exchanges. Traders quickly transfer funds between exchanges to execute the trades and capture profits.

Cross-border arbitrage involves buying the cryptocurrency on an exchange in one country where the price is lower and selling it on an exchange in another country where the price is higher. This method may require dealing with currency conversion and international transfers.

Exchange-to-exchange arbitrage occurs when a single cryptocurrency is traded on multiple exchanges, and the price differs between those exchanges. Traders move their funds between exchanges to exploit these price discrepancies.

It’s essential to note that crypto arbitrage trading involves risks and challenges, such as transaction costs, market volatility, and the speed of execution. Automated trading bots and algorithms are commonly used to increase the efficiency of executing arbitrage trades in the fast-paced cryptocurrency market. Traders should also consider factors like liquidity, trading fees, and withdrawal limits when implementing arbitrage strategies to ensure profitable outcomes.

Best Times for Arbitrage Trading

The best times for arbitrage trading in the cryptocurrency market depend on various factors, including market conditions, trading volumes, and price volatility. While crypto markets operate 24/7, there are certain periods that may present more favorable opportunities for arbitrage traders:

Volatile market conditions often lead to price discrepancies between different exchanges. Times of heightened market volatility, such as during major news events, significant announcements, or market corrections, can create more frequent and lucrative arbitrage opportunities.

Arbitrage opportunities may be more abundant during trading session overlaps when multiple major cryptocurrency markets are active simultaneously. For example, the overlap of Asian and European trading sessions may lead to price discrepancies that traders can capitalize on.

When a cryptocurrency is listed on a new exchange, there can be a delay in price adjustments between the exchanges, leading to temporary arbitrage opportunities.

Higher trading volumes on exchanges can create price disparities, especially during peak trading hours or periods of significant market activity.

Times of lower liquidity, such as during holidays or weekends, may result in more significant price divergences between exchanges, providing potential arbitrage opportunities.

Before major events like forks, airdrops, or token swaps, traders may anticipate price discrepancies and position themselves strategically to capitalize on the ensuing arbitrage opportunities.

Traders may choose quieter times or less volatile market conditions to test and refine their arbitrage strategies without significant risk exposure.

During peak network congestion, executing transactions on certain blockchains can lead to higher gas fees and delays. Arbitrage traders may choose less congested times to minimize transaction costs and enhance speed of execution.

It’s important to note that the cryptocurrency market is highly dynamic, and arbitrage opportunities can arise unexpectedly. Successful arbitrage trading requires vigilance, quick decision-making, and the ability to adapt to changing market conditions. Automated trading bots can also be beneficial in identifying and executing arbitrage opportunities swiftly and efficiently, regardless of the time of day. Additionally, traders should stay informed about market news, regulatory changes, and technical developments that can impact the market and their arbitrage strategies.

"Quote That"

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” – Warren Buffett

Arbitrage opportunities can be rare and short-lived, so when they present themselves, traders must be prepared to act swiftly and seize the chance for potential profits.

“It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

This quote emphasizes the importance of risk management and profitability, crucial elements of successful arbitrage trading.

How to find the best crypto arbitrage opportunity?

Finding the best crypto arbitrage opportunities requires a combination of diligent research, advanced tools, and swift execution. Here’s a step-by-step guide to help you identify and capitalize on profitable crypto arbitrage opportunities

Select cryptocurrencies or assets that are traded on multiple exchanges. Focus on popular and highly liquid cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), or stablecoins like USDT, as they are more likely to have arbitrage opportunities due to their widespread use.

Work with reputable and reliable exchanges with high trading volumes. Popular exchanges with a good track record are generally preferred, as they are more likely to have better liquidity and execution speed.

Utilize specialized arbitrage tracking tools and platforms that monitor cryptocurrency prices across various exchanges in real-time. These tools can help you identify potential arbitrage opportunities as soon as they arise, saving you valuable time.

Take into account the transaction costs associated with executing trades on different exchanges. Each exchange has its own fee structure, and these costs can vary significantly. High fees can eat into your potential profits, so choose exchanges with competitive fee structures.

Evaluate the potential profits of each arbitrage opportunity by considering the price difference between exchanges, transaction costs, and the amount of capital you plan to invest in the trade. Use a reliable arbitrage calculator to estimate potential gains accurately.

Some exchanges may have longer withdrawal times for certain cryptocurrencies. Factor in the time it takes for the funds to be transferred from one exchange to another when assessing an arbitrage opportunity. Delays in withdrawals can impact your ability to execute timely trades.

Assess the risks associated with each arbitrage trade. Be aware of market volatility and the possibility of price corrections before you can execute the trade. Use proper risk management techniques, such as setting stop-loss orders, to limit potential losses.

Successful arbitrage requires quick execution, as price discrepancies in the crypto market can be short-lived. Have your funds readily available on the exchanges you plan to use, and be prepared to act swiftly when an opportunity arises.

Consider using automated trading bots or algorithms specifically designed for crypto arbitrage. These tools can execute trades faster and more efficiently than manual trading, increasing your chances of capitalizing on opportunities.

Stay informed about market news and events that could potentially impact cryptocurrency prices. Sudden developments or announcements may lead to price discrepancies, creating arbitrage opportunities.

If you are new to crypto arbitrage, consider paper trading or using demo accounts to practice your strategies without risking real capital. This allows you to familiarize yourself with the process and assess the effectiveness of your approach before engaging in live trading.

Remember that crypto arbitrage involves risks, and the market can be highly competitive. It’s crucial to maintain a disciplined approach, conduct thorough research, and continuously adapt your strategies to changing market conditions. Regularly monitor the performance of your arbitrage trades and adjust your approach as needed to maximize profitability.

Pros

The primary advantage of crypto arbitrage is the potential for generating profits from price discrepancies between different exchanges. Traders can exploit these opportunities to make quick and relatively low-risk profits.

Arbitrage trading can serve as a means of diversification for a trader’s portfolio. It provides an opportunity to earn profits independently of the market’s overall direction, which can help balance overall portfolio performance.

Arbitrage trading contributes to market efficiency by helping to reduce price discrepancies between exchanges. As traders capitalize on price differences, the actions of arbitrageurs tend to bring prices closer to equilibrium.

By executing trades across multiple exchanges, arbitrageurs contribute to increased liquidity in the market, which can benefit all traders by reducing the bid-ask spread and facilitating smoother price movements.

Crypto arbitrage can be automated using trading bots or algorithms. Automated systems enable rapid execution, increased efficiency, and the ability to take advantage of fleeting opportunities in the fast-paced crypto market.

Cons

Arbitrage trades involve transaction costs such as trading fees and network gas fees. These costs can significantly impact profitability, especially when the price differences between exchanges are small.

Cryptocurrencies are known for their high price volatility. Sudden price swings can result in losses if an arbitrage trade is executed at the wrong time, or if there are delays in executing trades due to network congestion.

Executing arbitrage trades requires quick action to capitalize on fleeting opportunities. Delays in fund transfers or trade execution can lead to missed opportunities or less favorable prices.

Crypto arbitrage is a popular strategy, and many traders actively search for opportunities. Increased competition can make it challenging to find profitable trades consistently.

Engaging in arbitrage involves trusting multiple exchanges to handle your funds effectively. Not all exchanges have the same level of security and reliability, and the risk of exchange hacks or technical issues can impact trading outcomes.

Different exchanges may operate under varying regulatory environments, adding complexity to fund transfers and compliance requirements.

As the cryptocurrency market matures and becomes more efficient, arbitrage opportunities may become scarcer and less profitable.

While arbitrage is considered a relatively low-risk strategy, traders must still exercise proper risk management techniques to protect against unexpected market movements and potential losses.

Final Thoughts

Crypto arbitrage trading offers a potential avenue for traders to capitalize on price discrepancies between different exchanges and generate profits in the fast-paced cryptocurrency market. While it comes with advantages such as potential profits, risk diversification, and enhanced market efficiency, it also presents challenges, including transaction costs, market volatility, and execution delays. Success in crypto arbitrage requires diligent research, quick and efficient execution, and effective risk management. As the cryptocurrency ecosystem continues to evolve, arbitrage opportunities may evolve as well, making it crucial for traders to stay adaptable and vigilant in their pursuit of profitable opportunities.

In the fast-paced and ever-changing world of crypto markets, the ability to predict price movements and make informed trading decisions is paramount. Enter Technical Analysis, a powerful methodology that equips traders with valuable tools to analyze historical price data, identify patterns, and interpret market trends. In this comprehensive guide, we will explore the fundamental principles and concepts of Technical Analysis, uncovering its purpose, key principles, and distinguishing it from fundamental analysis.

Definition and Purpose of Technical Analysis

Technical Analysis is a method used by traders to evaluate and forecast future price movements in financial markets, including stocks, forex, commodities, and cryptocurrencies. It revolves around the idea that historical price data contains valuable insights that can be used to predict future price trends and behavior. The primary purpose of technical analysis is to identify patterns, trends, and potential entry and exit points in the market, allowing traders to make well-informed and objective trading decisions.

Key Principles and Concepts in Technical Analysis

At the core of Technical Analysis are several key principles and concepts:

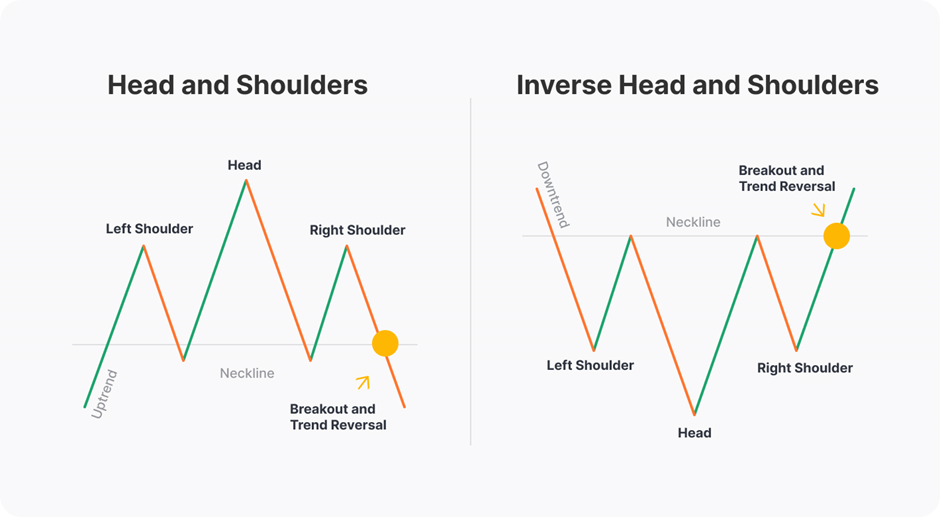

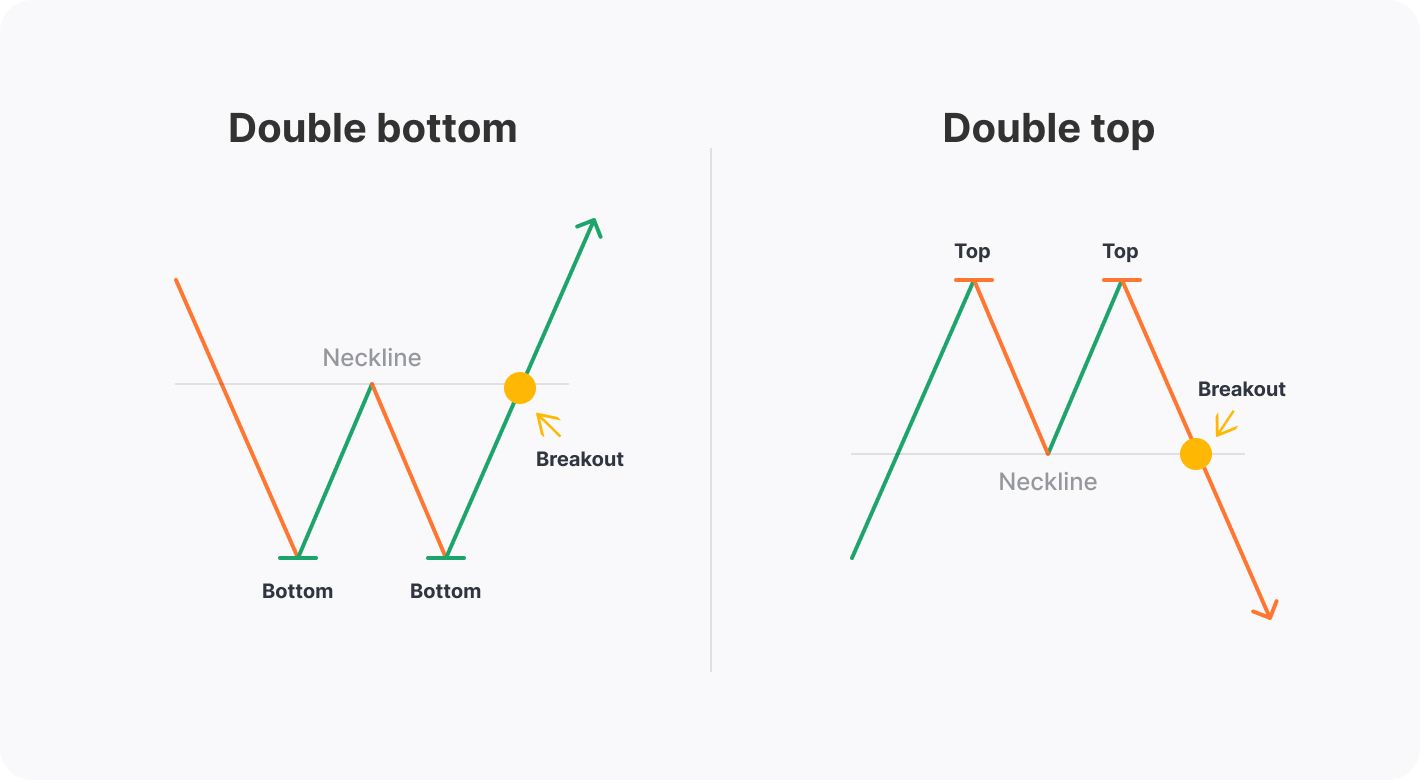

Traders study historical price charts to identify recurring patterns, such as head and shoulders, triangles, and double tops/bottoms. These patterns provide valuable information about potential trend reversals or continuations.

Technical analysts identify key price levels where an asset’s price tends to find support (stops falling) or resistance (stops rising). These levels act as psychological barriers and play a crucial role in understanding market sentiment.

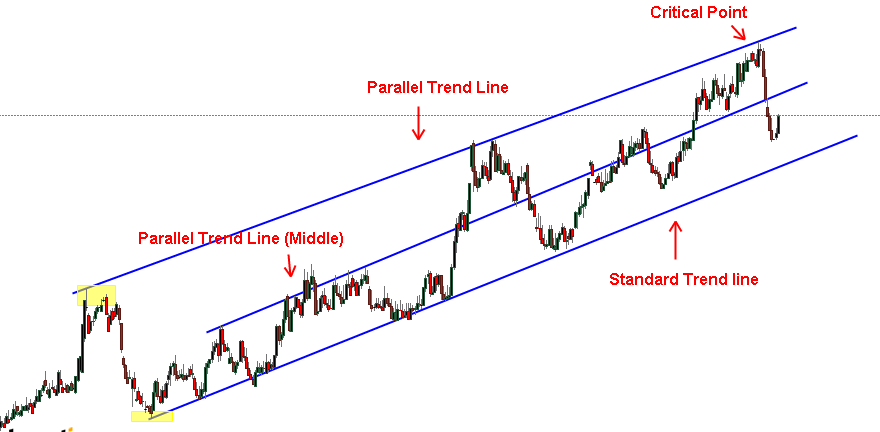

Technical analysts analyze price movements to identify trends, such as uptrends, downtrends, and sideways trends. Trendlines and moving averages are commonly used tools for trend analysis.

Various mathematical calculations, such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, are employed as technical indicators. These indicators help gauge market momentum, overbought or oversold conditions, and potential entry or exit points.

Trading volume is considered a significant factor in technical analysis. Changes in trading volume often confirm price movements and provide insights into the strength of market trends.

Understanding the Difference Between Technical Analysis and Fundamental Analysis:

While both Technical Analysis and Fundamental Analysis aim to assist traders in making informed decisions, they differ in their approach and focus. Technical Analysis is primarily concerned with studying price charts, historical data, and market behavior to forecast future price movements. It relies on the belief that past price patterns and trends can repeat in the future.

In contrast, Fundamental Analysis focuses on evaluating the intrinsic value of an asset by analyzing factors such as financial statements, economic indicators, industry trends, and company performance. It aims to determine the underlying worth of an asset to assess whether it is undervalued or overvalued in the market.

While both approaches have their strengths, technical analysis is particularly useful for short to medium-term trading, where identifying trends and patterns in price movements can lead to profitable trading opportunities.

Price Charts and Patterns in Technical Analysis

Price charts and patterns are fundamental elements of technical analysis, providing valuable insights into market behavior and aiding traders in making informed decisions. In this section, we will explore the different types of price charts, common chart patterns, and how to identify and interpret these patterns for trend analysis.

Types of Price Charts:

A line chart connects closing prices over a specific time period, forming a continuous line. It provides a simple overview of an asset’s price trend but lacks detailed information about intraday fluctuations.

A line chart connects closing prices over a specific time period, forming a continuous line. It provides a simple overview of an asset’s price trend but lacks detailed information about intraday fluctuations.

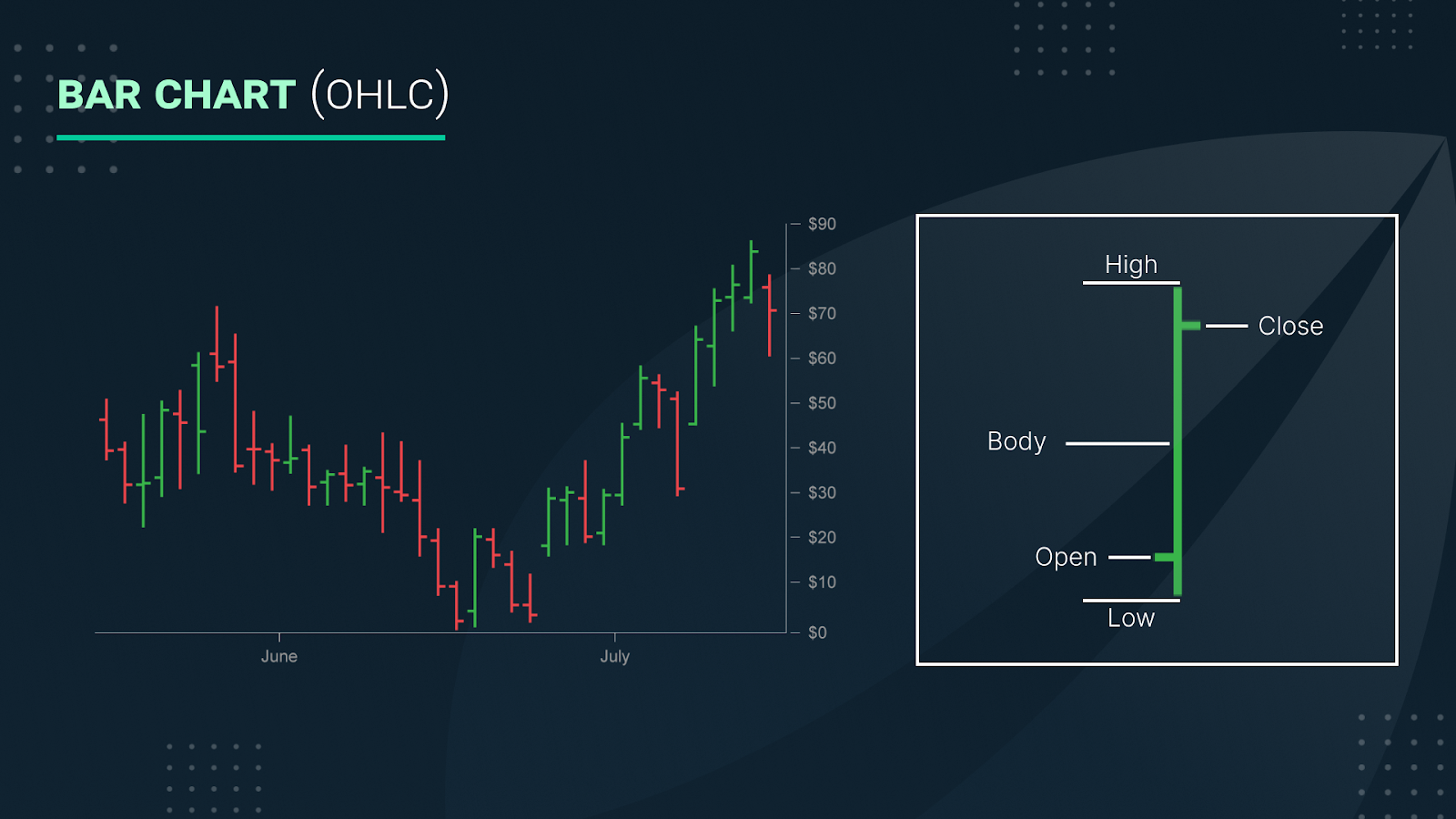

A bar chart displays four key price points for each time interval: the high, low, opening, and closing prices. Each bar represents a specific time period, providing a comprehensive view of price movements.

A bar chart displays four key price points for each time interval: the high, low, opening, and closing prices. Each bar represents a specific time period, providing a comprehensive view of price movements.

A candlestick chart presents the same information as a bar chart but in a visually appealing manner. Each candlestick consists of a “body” representing the opening and closing prices and “wicks” (shadows) indicating the high and low prices during the time period. Candlestick charts are widely used in technical analysis due to their ability to convey price patterns effectively.

A candlestick chart presents the same information as a bar chart but in a visually appealing manner. Each candlestick consists of a “body” representing the opening and closing prices and “wicks” (shadows) indicating the high and low prices during the time period. Candlestick charts are widely used in technical analysis due to their ability to convey price patterns effectively.

Common Chart Patterns:

This pattern consists of three peaks, with the central peak (the head) being higher than the other two (the shoulders). It suggests a potential trend reversal from bullish to bearish.

This pattern consists of three peaks, with the central peak (the head) being higher than the other two (the shoulders). It suggests a potential trend reversal from bullish to bearish.

These patterns occur when the price reaches two consecutive peaks (double tops) or two consecutive troughs (double bottoms) of approximately the same height. They often indicate potential trend reversals.

These patterns occur when the price reaches two consecutive peaks (double tops) or two consecutive troughs (double bottoms) of approximately the same height. They often indicate potential trend reversals.

Triangles are chart patterns formed by converging trendlines, creating a triangle shape. There are three main types: ascending triangles, descending triangles, and symmetrical triangles. They typically signal potential breakout movements.

Triangles are chart patterns formed by converging trendlines, creating a triangle shape. There are three main types: ascending triangles, descending triangles, and symmetrical triangles. They typically signal potential breakout movements.

Identifying and Interpreting Price Patterns for Trend Analysis

By analyzing price patterns, traders can identify trends in the market, such as uptrends (higher highs and higher lows), downtrends (lower highs and lower lows), or sideways trends (sideways price movements).

By analyzing price patterns, traders can identify trends in the market, such as uptrends (higher highs and higher lows), downtrends (lower highs and lower lows), or sideways trends (sideways price movements).

Price patterns also help traders identify key support and resistance levels. Support levels are where prices tend to find buying support, preventing further declines. Resistance levels, on the other hand, are where prices face selling pressure, preventing further advances.

Price patterns also help traders identify key support and resistance levels. Support levels are where prices tend to find buying support, preventing further declines. Resistance levels, on the other hand, are where prices face selling pressure, preventing further advances.

Chart patterns often precede breakout movements or trend reversals. A breakout occurs when the price breaks above or below a significant support or resistance level, indicating a potential shift in the trend’s direction.

Traders can use technical indicators, such as Moving Averages or the Relative Strength Index (RSI), to confirm price patterns and validate potential trend changes.

Understanding these patterns can help traders identify trend directions, forecast potential price movements, and make well-informed trading decisions. When combined with other aspects of technical analysis, such as technical indicators and volume analysis, price patterns become powerful tools in navigating the dynamic world of financial markets and maximizing trading success.

Technical Indicators in Technical Analysis

Technical indicators are essential tools used by traders to gain deeper insights into market trends, momentum, and potential price reversals. Popular technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Moving Averages, these indicators can help gauge market momentum and overbought/oversold conditions.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100, with readings above 70 indicating overbought conditions, and readings below 30 suggesting oversold conditions. The RSI is calculated based on the average of up and down closes over a specified period. It helps traders identify potential trend reversals and determine whether an asset is overbought or oversold, thus providing valuable insights into market sentiment.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100, with readings above 70 indicating overbought conditions, and readings below 30 suggesting oversold conditions. The RSI is calculated based on the average of up and down closes over a specified period. It helps traders identify potential trend reversals and determine whether an asset is overbought or oversold, thus providing valuable insights into market sentiment.